GIVE THE PERFECT GIFT

Erin Mills Town Centre Gift Cards are the perfect choice for your gift giving needs.Purchase gift cards at kiosks near the food court or centre court, at Guest Services, or click below to purchase online.PURCHASE HEREHome

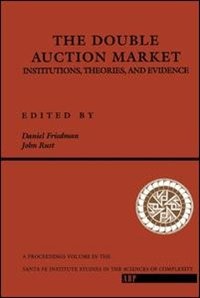

The Double Auction Market by Daniel Friedman, Paperback | Indigo Chapters

Indigo

Loading Inventory...

The Double Auction Market by Daniel Friedman, Paperback | Indigo Chapters

From Daniel Friedman

Current price: $94.95

From Daniel Friedman

The Double Auction Market by Daniel Friedman, Paperback | Indigo Chapters

Current price: $94.95

Loading Inventory...

Size: 0.9 x 8.9 x 1.42

*Product information may vary - to confirm product availability, pricing, shipping and return information please contact Indigo

This collection of papers focuses on markets organized as double auctions (DA). In a double auction, both buyers and sellers can actively present bids (offers to buy) and asks (offers to sell) for standardized units of well-defined commodities and securities. A classic example of a DA market (known by practitioners as an open outcry market) is the commodity trading pit at the Chicago Board of Trade. A related process is a call market, which is used to determine opening prices on the New York Stock Exchange. Already the predominant trading institution for financial and commodities markets, the double auction has many variants and is evolving rapidly in the present era of advancing computer technology and regulatory reform. DA markets are of theoretical as well as practical interest in view of the central role these institutions play in allocating resources. Although the DA has been studied intensively in the laboratory, and practitioners have considerable experience in the field, only recently have tools started to become available to provide the underpinning of a behavioral theory of DA markets. | The Double Auction Market by Daniel Friedman, Paperback | Indigo Chapters

This collection of papers focuses on markets organized as double auctions (DA). In a double auction, both buyers and sellers can actively present bids (offers to buy) and asks (offers to sell) for standardized units of well-defined commodities and securities. A classic example of a DA market (known by practitioners as an open outcry market) is the commodity trading pit at the Chicago Board of Trade. A related process is a call market, which is used to determine opening prices on the New York Stock Exchange. Already the predominant trading institution for financial and commodities markets, the double auction has many variants and is evolving rapidly in the present era of advancing computer technology and regulatory reform. DA markets are of theoretical as well as practical interest in view of the central role these institutions play in allocating resources. Although the DA has been studied intensively in the laboratory, and practitioners have considerable experience in the field, only recently have tools started to become available to provide the underpinning of a behavioral theory of DA markets. | The Double Auction Market by Daniel Friedman, Paperback | Indigo Chapters